The global economic crisis is having a greater impact on developing countries, with low economic growth rates, higher interest rates and an increase in their debts. These elements are creating the perfect mix to trigger credit defaults in emerging countries, including Mexico, of course.

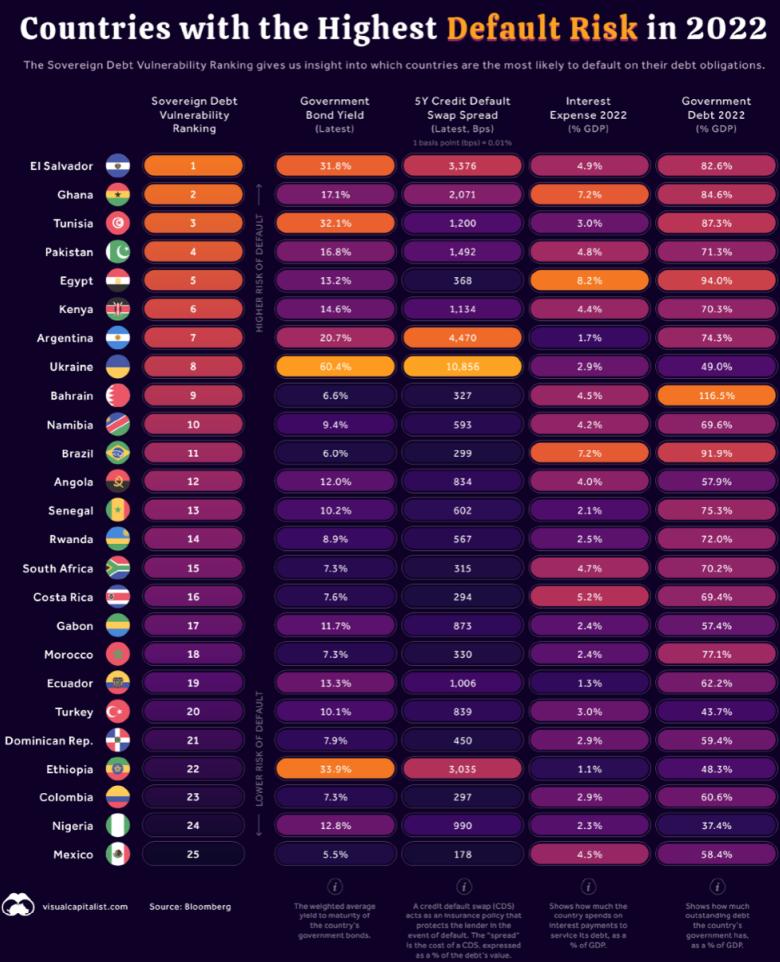

According to Bloomberg’s Sovereign Debt Vulnerability Ranking, Mexico ranks 25th on its list of nations with the highest risk of default in 2022. This ranking analyzes the vulnerability of sovereign debt, or, in other words, the risk of default (non-payment of sovereign debt) that a country has.

To arrive at that ranking, Bloomberg evaluates four main factors:

- Government bond yields (the weighted average yield on the country’s dollar-denominated bonds).

- 5-year Credit Default Swap (CDS) spread

- Interest expense as a percentage of GDP

- Public debt as a percentage of GDP

According to its metrics, Mexican government bond yields (dollar-weighted average of bonds) are 5.5 percent, while Ukraine’s yields stand at 60.4 percent. As a point of comparison, the yield on a 10-year U.S. government bond is currently 2.9 percent.

Ukraine’s bond yields are the highest within Bloomberg data because the country has a high default risk from its conflict with Russia. If Russia takes control of the country, Ukraine’s existing debt obligations may never be repaid.

What are CDS and why are they important?

Another measure in which Mexico is evaluated is CDS (Credit Default Swap), with 178 basis points. These instruments are a type of derivative that provides an investor with insurance in case of default by the debtor. The seller of the CDS represents a third party between investors and governments.

In exchange for receiving coverage, the buyer of a CDS pays a fee, known as a spread, which is expressed in basis points (bps). If a CDS has a spread of 300 bps (3 percent), this means that, to insure $100 of debt, the investor must pay $3 per year.

In the case of Mexico with a 5-year CDS spread of 178 bps (1.78 percent), an investor would have to pay $1.78 to insure $100 of debt. In the case of Ukraine which has 10,856 bps (108.56 percent), an investor would have to pay $108.56 each year to insure $100 of debt. This suggests that there is little faith in Ukraine’s ability to avoid default, for obvious reasons.

Why is Mexico ranked 25th?

While in the first two metrics Mexico does not look so bad – in interest expense and total government debt as a percentage of GDP, the assessment is not so positive. Mexico’s debt interest expense stands at 4.5 percent as a percentage of GDP, and government debt is 58.4 percent of national GDP, even though with López Obrador in office this indicator has not grown as it did during Peña Nieto’s administration. Luis Videgaray’s term as Treasury Secretary was disastrous in terms of indebtedness, and only the arrival of José Antonio Meade put a brake on it. It was not for nothing that the peso also suffered a severe depreciation during that six-year term.

But returning to the defaults ranking, it is striking that El Salvador – the first country in the world to impose bitcoin as legal tender – is at the top of the list due to its higher interest expense and total government debt, as it has annual interest payments equivalent to 4.9 percent of its GDP, while its outstanding debts are equivalent to 82.6 percent of GDP, figures that are considered high according to IMF analysis.

While bitcoin adoption is not directly related to its sovereign risk, it has opened up an unnecessary flank that, whether President Bukele likes it or not, negatively affects its country risk.

Below you can see the list compiled by Visual Capitalist, which is more than eloquently speaks for itself.

Mexico is not doing well.